Secret Tips for Submitting an Online Tax Return in Australia and Avoiding Typical Mistakes

Secret Tips for Submitting an Online Tax Return in Australia and Avoiding Typical Mistakes

Blog Article

Navigate Your Online Income Tax Return in Australia: Necessary Resources and Tips

Navigating the on the internet tax obligation return process in Australia calls for a clear understanding of your commitments and the sources readily available to improve the experience. Important papers, such as your Tax File Number and revenue statements, have to be carefully prepared. Selecting a suitable online platform can significantly affect the efficiency of your filing process. As you consider these factors, it is important to also know usual mistakes that several experience. Understanding these nuances can inevitably conserve you time and minimize stress and anxiety-- bring about an extra beneficial result. What approaches can best assist in this endeavor?

Comprehending Tax Commitments

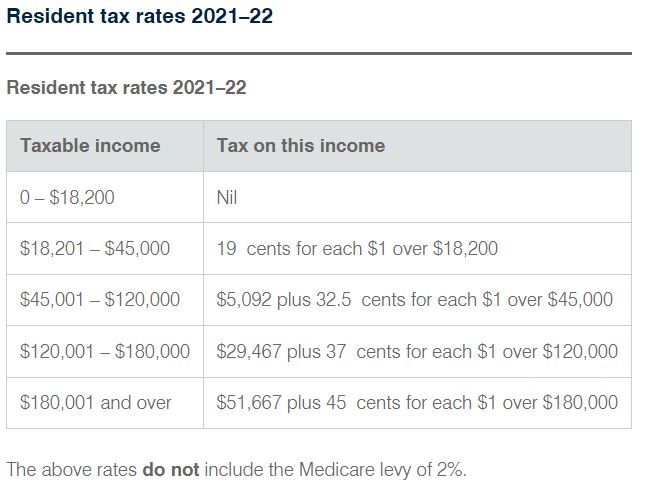

Recognizing tax commitments is crucial for individuals and services operating in Australia. The Australian taxation system is controlled by various laws and guidelines that require taxpayers to be familiar with their responsibilities. People must report their income precisely, that includes incomes, rental revenue, and financial investment incomes, and pay tax obligations accordingly. Locals need to comprehend the difference in between non-taxable and taxable revenue to make certain conformity and optimize tax obligation outcomes.

For businesses, tax commitments incorporate several facets, including the Goods and Provider Tax Obligation (GST), business tax, and payroll tax. It is vital for organizations to register for an Australian Service Number (ABN) and, if suitable, GST registration. These duties demand meticulous record-keeping and timely submissions of income tax return.

Additionally, taxpayers ought to be familiar with readily available reductions and offsets that can relieve their tax obligation problem. Seeking guidance from tax obligation professionals can give beneficial understandings into maximizing tax obligation positions while making sure conformity with the law. On the whole, an extensive understanding of tax obligation obligations is essential for reliable financial preparation and to prevent penalties connected with non-compliance in Australia.

Necessary Files to Prepare

In addition, compile any kind of appropriate financial institution statements that mirror passion income, in addition to reward statements if you hold shares. If you have various other incomes, such as rental residential or commercial properties or freelance job, guarantee you have documents of these profits and any kind of connected expenses.

Do not fail to remember to include reductions for which you might be qualified. This might entail invoices for job-related expenditures, education prices, or charitable donations. Take into consideration any kind of private health insurance coverage statements, as these can affect your tax responsibilities. By gathering these essential documents in breakthrough, you will certainly enhance your on the internet income tax return procedure, decrease mistakes, and maximize prospective reimbursements.

Selecting the Right Online System

As you prepare to submit your on the internet income tax return in Australia, picking the best platform is necessary to guarantee precision and convenience of usage. A number of essential aspects should lead your decision-making process. Take into consideration the system's user interface. An uncomplicated, instinctive design can significantly boost your experience, making it less complicated to browse complicated tax return.

Following, examine the platform's compatibility with your financial circumstance. Some services cater especially to individuals with straightforward income tax return, while others offer thorough support for much more complex scenarios, such as self-employment or investment earnings. Furthermore, look for platforms that offer real-time mistake checking and support, assisting to lessen blunders and making sure compliance with Australian tax obligation legislations.

One more crucial facet to think about is the level of customer support readily available. Trustworthy systems should offer access to support through e-mail, phone, or conversation, specifically throughout height declaring durations. In addition, research customer reviews and ratings to determine the general fulfillment and integrity of the platform.

Tips for a Smooth Declaring Refine

If you adhere to a couple of essential ideas to make certain efficiency and accuracy,Submitting look at this web-site your on-line tax return can be a straightforward procedure - online tax return in Australia. Collect all essential papers prior to starting. This includes your income statements, receipts for deductions, and any other relevant paperwork. Having whatever at hand decreases interruptions and mistakes.

Next, take benefit of the pre-filling function supplied by several on the internet systems. This can conserve time and minimize the possibility of errors by instantly occupying your return with details from previous years and data offered by your company and monetary organizations.

Additionally, confirm all entrances for accuracy. online tax return in Australia. Blunders can lead to delayed reimbursements or issues with the Australian Tax Workplace (ATO) Make certain that your personal details, earnings figures, and reductions are appropriate

Filing early not just decreases anxiety however also permits for better preparation if you owe tax obligations. By following these ideas, you can navigate the on-line tax return process efficiently and with confidence.

Resources for Support and Assistance

Browsing the complexities of on the internet income tax return can sometimes be difficult, however a selection of sources for aid and support are easily available to assist taxpayers. The Australian Taxes Office (ATO) is the main source of information, offering extensive overviews on its web site, consisting of FAQs, training videos, and live conversation alternatives for real-time assistance.

In Addition, the ATO's phone support line is readily available for those that prefer straight interaction. online tax return in Australia. Tax obligation experts, such as authorized tax obligation agents, can additionally provide individualized guidance and make sure compliance with present tax obligation guidelines

Verdict

Finally, properly navigating the online tax return procedure in Australia needs a comprehensive understanding of tax obligation commitments, thorough prep work of crucial records, and cautious selection of an appropriate online platform. Adhering to useful tips can boost the filing experience, while readily available sources offer important aid. By coming close to the process with persistance and attention to detail, taxpayers can guarantee compliance and make the most of prospective advantages, ultimately adding to a much more effective and efficient tax obligation return end result.

As you prepare to submit your on the internet tax return in Australia, picking the ideal system is important to make certain accuracy and ease of use.In final thought, effectively navigating the online tax return procedure in Australia needs a complete understanding of tax obligation commitments, thorough prep work of essential records, and cautious selection of a suitable online platform.

Report this page